If you’re thinking about getting an Apple Card Mastercard, you want the process to be as smooth as possible.

This guide will walk you through everything, step by step. Knowing what to expect can take away a lot of the mystery, whether it’s your first credit card or you just want to add something new to your wallet.

Here’s how you can confidently apply for Apple’s digital credit card and start taking advantage of its perks.

Apple Card Mastercard: Key Features and Why It’s Different

The Apple Card Mastercard isn’t just another credit card. It’s designed primarily for those who prefer the convenience of managing money digitally, especially within the Apple ecosystem. Unlike many traditional credit cards, it has no annual fee, no foreign transaction fees, and integrates directly with the Wallet app on your iPhone. You’ll get:

- Daily cash-back rewards (up to 3% on Apple purchases)

- Real-time transaction tracking within the Wallet app

- Enhanced security and privacy features

- Clear, transparent fee structure

- In-app customer support (text or call)

I remember the first time I used the Apple Card to buy something in an Apple Store—it was near-instant, and seeing the cash-back appear right away actually felt rewarding. Maybe it’s silly, but little things like that make the experience stand out.

Who Can Apply? Apple Card Eligibility Requirements

Before filling out your application, check if you meet some basic criteria. This saves time and possible frustration down the road.

Age and Residency

Applicants must be 18 years or older and have a valid U.S. residential address. If you’re outside the U.S., unfortunately, the Apple Card isn’t available just yet. But perhaps that’ll change in the future—it does seem like an obvious step, right?

Credit Score Expectations

While Apple and Goldman Sachs (the issuing bank) don’t publish an official minimum score, most successful applicants have a FICO score above 600. If your credit history is good—or you’re working to improve it—your odds are better. A higher score not only boosts your approval chances but can earn you a lower APR (Annual Percentage Rate) as well.

Not certain of your score? It’s easy to check for free using services like Experian or Credit Karma. Remember, applying for the card triggers a hard inquiry, which can lower your score, even if only by a few points (and only for a short while). So it’s worth knowing your number ahead of time.

Required Documents

To apply, you’ll need:

- Your Social Security Number

- A valid U.S. photo ID (driver’s license or state ID)

- Current income information

- Your official U.S. mailing address and phone number

It sounds a little formal, but these checks help protect both sides. Having everything handy will speed up the process.

How to Apply for Apple Card Mastercard: Step-by-Step Process

The application is all digital—no paperwork or waiting for the mail. Here’s what you do:

Step 1: Open the Wallet App

First, grab your iPhone and open the Wallet app. Tap the “+” in the upper right corner, then choose Apple Card from the list. If you don’t see the option, make sure your device’s iOS is up-to-date—it’s vital for a smooth application. (Odd as it sounds, some users miss this simple fix.)

Step 2: Sign in With Your Apple ID

The app will ask for your Apple ID username and password for authentication. This ties the card to your Apple account and helps with security.

Step 3: Enter Personal Information

You’ll be prompted for your legal name, address, date of birth, income, and the last four digits of your Social Security Number. Double-check everything—it sounds obvious, but even a small typo can delay your approval.

Step 4: Agree to Terms

Carefully read the terms and conditions. This section will list out fees, minimum payments, privacy info, and other legal details. Click to agree and continue. I’ll admit: I had to backtrack during this step once just to make sure I hadn’t missed anything in the fine print.

Step 5: Submit and Wait for a Decision

When you hit “Submit,” Goldman Sachs runs a quick credit check. Often, you’ll get an answer within a minute or two—it really is that fast.

Step 6: Set Up Digital Use and Request Physical Card

If approved, you can begin using the card right away via Apple Pay. You also have the option to request a titanium physical card for free—it’s a slick little piece of metal, honestly, and stands out compared to regular plastic cards.

What If You’re Denied?

No one likes rejection, especially from a computer. If your application is declined, check the message inside the Wallet app for the reason. It could be low credit score, insufficient income, or inaccurate info.

- Review your recent credit activity—have you missed payments or opened a lot of accounts?

- Consider checking your free credit report (you’re entitled to one per year at AnnualCreditReport.com).

- Think about improving any weak areas—paying down balances or waiting until recent hard inquiries age off can help.

You can always reapply later, ideally after your financial standing improves.

Apple Card Interest Rates and Potential Fees

Even with its sleek features, the Apple Card is still a credit card—responsible use is key. Here’s what you should know about costs:

Variable APR Rates

Apple Card’s APR is variable, meaning it can rise or fall with the Prime rate. Your actual APR depends on your credit score; generally, higher scores get lower rates. At the time of writing, the rate range is from 19.24%–29.49% variable APR, but it can change, so check the official site for updates.

Fee Breakdown Table

Here’s a quick look at the Apple Card’s fees—what’s charged, when, and why it matters.

| Fee Type | Amount | When It Applies |

|---|---|---|

| Annual Fee | $0 | Never |

| Foreign Transaction | $0 | International purchases |

| Late Payment | Up to $40 | If you miss a due date |

| Over-limit | $0 | N/A |

One of the features I appreciate most: no sudden ‘gotcha’ fees for things like going over your credit limit or shopping abroad. That’s not always the case with other cards, in my experience.

Apple Card Rewards: How Does Cash Back Work?

The Apple Card gives Daily Cash—real cash, not points. For eligible purchases, you get:

- 3% on Apple and select merchant purchases (including Uber, Walgreens, Nike, and others)

- 2% on all Apple Pay purchases

- 1% on everything else (using the physical card)

Your cash back automatically appears within a day, which makes it easy to see your rewards and use them. There’s no need to wait for the end of the month or meet a minimum threshold to redeem.

Security, Privacy, and Control

Apple leans into privacy, and the Apple Card reflects that. Each purchase requires biometric authentication (Face ID or Touch ID), and your actual card number is never stored on your device or shared with merchants. You can generate new card numbers on demand inside your Wallet app for extra protection against online fraud.

Lost your device or card? You can freeze or remove your card instantly from another Apple device, which is much simpler than the old phone-call routine.

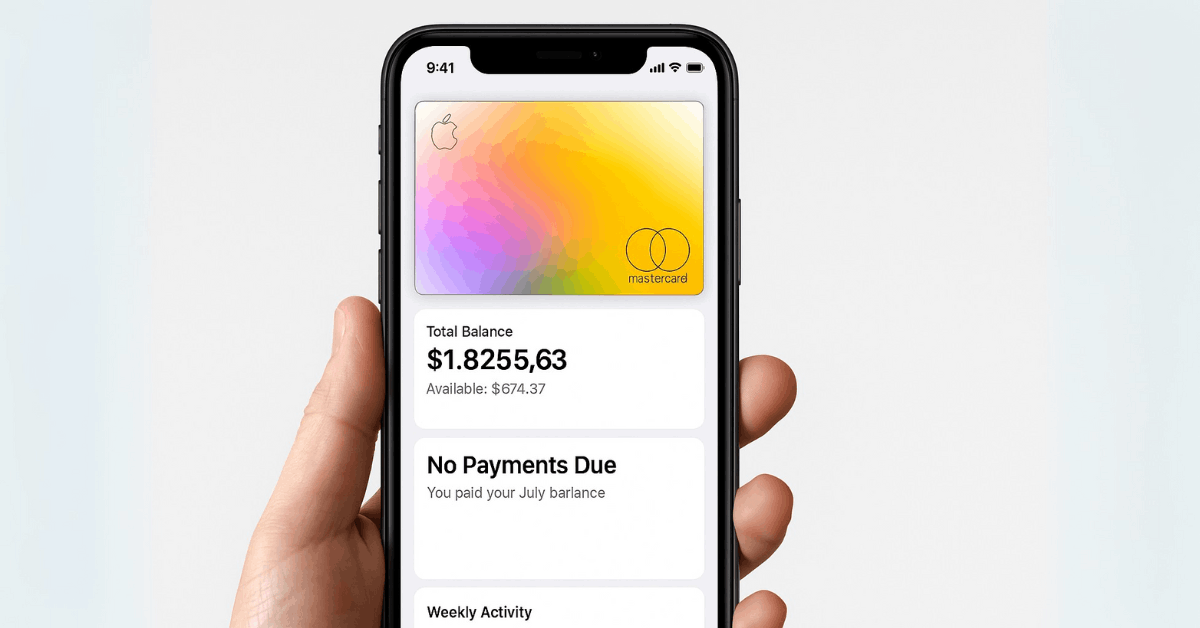

Managing Apple Card: In-App Financial Tools

With Apple Card, you get expense tracking, payment forecasts, and tools for managing debt—all inside the Wallet app. You can see category breakdowns for your spending, set goals, and even pay bi-weekly or more often to reduce interest (something not every credit card lets you do).

- Spending summaries each month

- Automatic notifications for due payments

- Suggestions for paying less interest over time

If you’re new to digital budgeting, these features are surprisingly helpful. Honestly, I’ve found myself checking in more often than I’d thought I would, just to make sure things are on track.

Apple Card Customer Support: Getting Help When Needed

Apple partners with Goldman Sachs to issue the card, and support options are fairly robust:

- For questions or issues, call 877-255-5923

- Visit the Apple Card Support Page

- Text directly from your Wallet app for real-time help

- For mail correspondence: Goldman Sachs Bank, P.O. Box 7247, Philadelphia, PA 19170-0001

Keep your account details handy for faster support. In my case, texting from the app was by far the simplest way to reach someone about a billing question—much faster than waiting on hold.

For updates or error troubleshooting, always refer to the official Apple Card site.

Frequently Asked Questions

Let’s wrap up with some commonly asked questions (because, frankly, everyone has a few before applying):

- Can I use Apple Card if I don’t have an iPhone? – No, the card requires an iPhone to apply and to manage your account.

- Is there a minimum income? – Officially, no—but reasonable income helps during approval.

- When do I get my physical card? – Generally within a week, after approval and your digital card are both activated.

Final Thoughts: Ready to Apply for Apple Card Online?

Applying for the Apple Card Mastercard online is, honestly, as easy as it gets in the world of credit cards—especially if you follow this step-by-step guide and prepare all your documents ahead of time. From daily cash-back to no hidden fees and handy Wallet integration, the card fits especially well into an Apple-centric lifestyle. But, as always, make sure you read the terms and use your credit responsibly.

Ready to get started? Download the Wallet app and apply now—it only takes a few minutes.

Note: Details like APR and rewards rates are correct as of publication. Always double-check directly with Apple or Goldman Sachs, as terms may change.